WORKSHOP

Workshop 1:

Why Sustainability?

The Business Case for Sustainability.

Wednesday | 12th June 2024 | 11 am to 12 pm

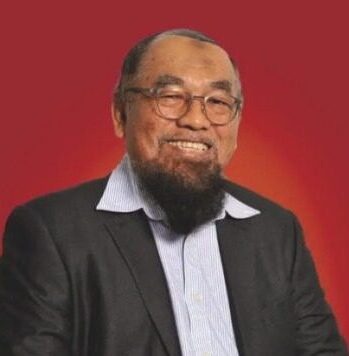

Speaker: Mr Fareed Abdul Ghani – CEO, Mindsight Sdn Bhd

Area of Competency: Sustainability

Moderator: En Norfadelizan Abdul Rahman

Addressing the environmental impact of businesses and promoting sustainability is crucial for mitigating climate change, preserving natural resources, and ensuring the well-being of current and future generations. Sustainability refers to the ability to meet the needs of the present without compromising the ability of future generations to meet their own needs. It involves balancing environmental, social, and economic considerations to ensure that human activities do not deplete natural resources, degrade ecosystems, or harm communities. There are three main pillars of sustainability, namely, environmental, social and economic. In this workshop Mr. Fareed will guide participants to achieving sustainability through a holistic and integrated approach by interconnecting environmental, social, and economic systems. Understanding sustainability helps participants and societies recognize the impact of their actions on the environment and it encompasses social equity and justice. Sustainable practices often lead to long-term economic stability. Climate change, pollution, deforestation, and other environmental issues are global challenges that require collective action. Learning about sustainability is essential for creating a more just, prosperous, and resilient world for present and future generations. It involves making informed decisions and adopting practices that balance the needs of people, planet, and prosperity both now and in the future.

Workshop 2:

Developing Leaders with Technology Global Mindset

Wednesday | 12th June 2024 | 12 pm to 1 pm

Speaker: Mr Mohammad Ridzuan Abdul Aziz – Independent director with AEON Bank Malaysia, the 1st Islamic digital bank in Malaysia.

Area of Competency: Leadership

Moderator: En Makhtar Abdullah

In today’s technology-driven world, leaders must cultivate a global mindset to effectively manage diverse teams, embrace innovation, and navigate the complexities of a global market. With technology reducing geographical boundaries, businesses now operate on a global scale. A technology global mindset helps leaders and professionals navigate this complex environment, enabling them to understand international markets, cross-cultural challenges, and the global supply chain. A technology global mindset encourages the integration of varied ideas, fostering an environment where innovation thrives. It leads to better problem-solving and creative solutions by drawing from a broader range of cultural experiences and insights. In addition, global challenges like climate change, cybersecurity, and global health require a collaborative approach. A technology global mindset enables individuals to work across borders to find solutions to these complex issues. It also helps identify and leverage global opportunities, driving business growth. Technology is evolving rapidly, with trends like artificial intelligence (AI), the Internet of Things (IoT), and blockchain reshaping industries. A technology global mindset fosters adaptability, allowing individuals to stay ahead of technological changes and respond effectively to new trends. Therefore, this workshop is designed to help leaders develop a technology global mindset, focusing on leveraging technology to build cross-cultural connections, manage remote teams, and lead innovation in a multicultural setting. Through case studies, and discussions, participants will learn the skills and strategies necessary to lead technology teams with a global perspective, embracing cultural diversity and adapting to the fast-paced changes in technology.

Workshop 3:

Case study – Feasibility study to introduce Islamic banking services in the Russian Republic.

Wednesday | 12th June 2024 | 2.30 pm to 3.30 pm

Speaker: Professor Dr. Barjoyai Bardai – Economist & A highly respected project management consultant

Area of Competency: Strategic Planning

Moderator: Haji Rustam Mohd Idris

Russia launched the Islamic banking system in four major Muslim-dominated regions – Chechnya, Dagestan, Tatarstan and Bashkortostan. With a sizeable Muslim population estimated to be up to 25 million, Islamic financial institutions have existed in Russia until now, but this is the first time the country’s legislation has officially endorsed its launch. Prof. Dr Barjoyai was a Project Director, leading a team of Islamic Banking and Finance experts (comprising of ex-Bankers and professional in Islamic Banking and Finance) and successfully completed a consultancy assignment as Advisors to the Russian Government and the Tatarstan State in conducting feasibility study of implementing an Islamic bank in Russia. Conducting a feasibility study for implementing an Islamic bank in Russia involves thorough planning, research, and analysis. Effective project management is crucial to ensure the study covers all necessary aspects and delivers actionable insights. It provides the structure and discipline needed to navigate regulatory challenges, develop Islamic banking products, build IT infrastructure, manage risks, train staff, and launch operations. By following a project management approach, organizations can increase their chances of successfully establishing an Islamic bank in a unique regulatory and cultural environment like Russia. Project management serves as a mechanism to translate strategic plans into actionable outcomes and it involves setting long-term goals and objectives for an organization and developing plans to achieve them. On the other hand, it focuses on executing these plans through structured initiatives. By integrating project objectives with strategic objectives, organizations can ensure that every project contributes to the broader mission and vision. In summary, project management is integral to the successful execution of strategic management. It provides the structure, tools, and processes needed to turn strategic goals into tangible results. By ensuring projects align with strategic objectives, managing resources effectively, mitigating risks, and promoting adaptability, project management helps organizations achieve their long-term goals.

Workshop 4:

Common Challenges in Funding Social Impact Programmes and Future Growth of SMEs

Wednesday | 12th June 2024 | 3.30 pm to 4.30 pm

Speaker: CT Choo – Advocate & Solicitor, Chairman of the Federation of Interest Scheme Operators Malaysia (FISOM) & Member of the Expert Panel on Interest Schemes, Companies Commission of Malaysia

Area of Competency: Social Finance

Moderator: Dato Mustafha Hj Abd Razak.

SMEs and Social Finance Programmes share a similar journey in seeking access to funding. As commercial entities SMEs are required to have a common financial language and data that helps banks and investors to understand their growth prospects. Social Finance Programmes also requires the same financial language and data except that unlike SMEs they are usually “greenfield” projects without any track record. Similar and, yet, different. Both require the same entrepreneurial energy and skill sets. This workshop aims to help participants understand the importance of constantly engaging with governments to formulate fiscal policies that incentivizes the private sector to be even more participative in Social Finance Programmes. In this workshop the learning outcomes include obtaining some understanding of what financial institutions and investors are looking for, the need for a good business plan or project plan, the importance of good record-keeping to show accountability and the need for a high level of leadership energy to sustain the growth of SMEs or the successful impact of the Social Finance Programme, as the case may be.

ENQUIRY

For enquiry please email to ahibs-actconference@utm.my or fill up form below :